Préparation de documents liés à l’emploi

Nos spécialistes vous soutiennent avec tous les documents clés requis à chaque étape du parcours de l’emploi, y compris les contrats, les accords de non-divulgation, les avenants et les lettres de résiliation. Chaque document est préparé par des professionnels et aligné sur les normes légales et réglementaires.

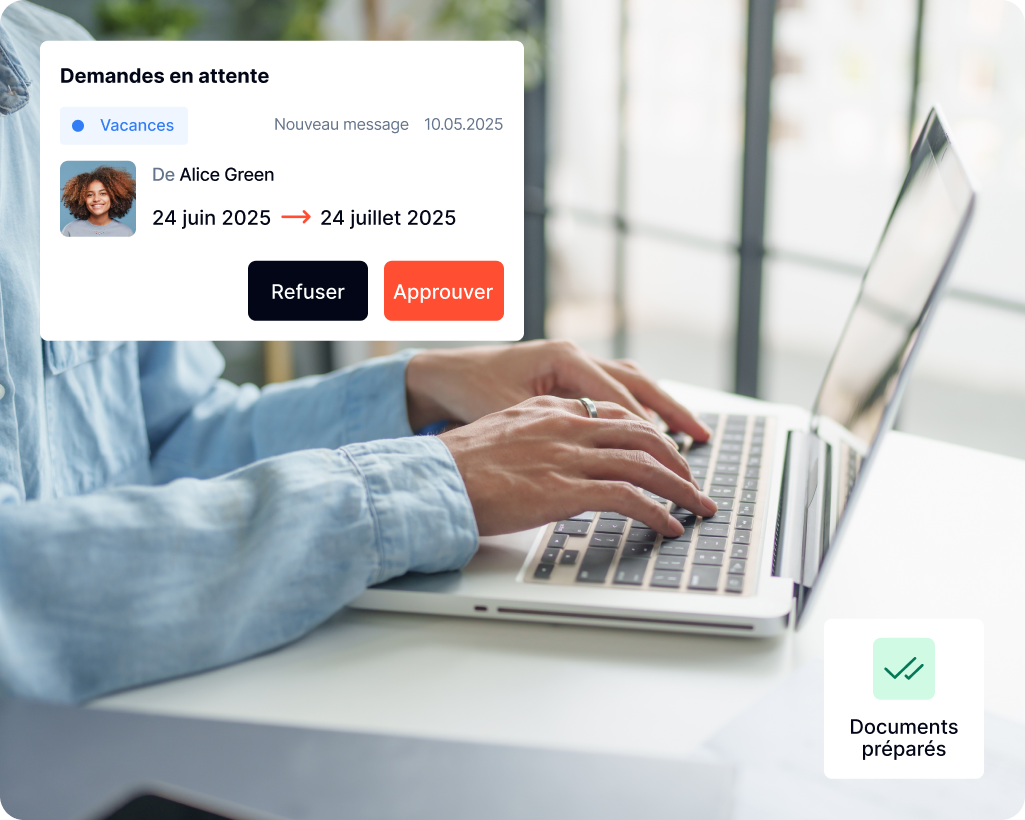

Suivi des fiches de temps et des vacances des employés

Nous fournissons des outils de suivi pour les heures des employés et les jours de vacances, vous aidant à gérer l’allocation du temps par projet, à surveiller les charges de travail et à planifier les ressources efficacement.

Gestion des cas d’assurance maladie et accident

En cas d’accident du travail, de maladie ou d’autres incidents liés à la santé, nous gérons l’ensemble du processus, de la déclaration de sinistre à la soumission de la documentation nécessaire. Notre équipe gère chaque étape avec précision et diligence, maintenant la conformité avec les procédures d’assurance et les obligations de l’employeur.