Prolongation du délai pour votre déclaration d’impôts en Suisse : un guide pratique

Remplir votre déclaration d’impôt en Suisse ne doit pas être une course contre la montre.

Raisons de demander une prolongation de délai

Le système fiscal suisse inclut une fonctionnalité utile que beaucoup de gens ignorent : vous pouvez demander plus de temps pour finaliser vos documents sans aucune pénalité.

Ce temps supplémentaire n’est pas seulement réservé aux personnes qui ont commis des erreurs ou qui s’y sont prises trop tard. De nombreux contribuables organisés utilisent cette option chaque année, car elle leur permet de préparer de meilleures déclarations et d’éviter des erreurs coûteuses. Avec plus de temps, vous pouvez vérifier vos chiffres, attendre les documents manquants et vous assurer que tout est correct avant de soumettre.

Les autorités suisses comprennent que les gens ont besoin de flexibilité, surtout lorsqu’ils sont confrontés à des situations financières complexes ou à des événements de vie imprévus. Ce guide explique précisément comment demander une prolongation de délai et ce que vous devez savoir sur le processus.

Que signifie réellement une prolongation du délai de dépôt ?

Une prolongation du délai pour la déclaration d’impôts en Suisse est une demande formelle qui vous accorde plus de temps pour préparer et soumettre votre déclaration annuelle. C’est une option utile pour ceux qui ont besoin de quelques mois supplémentaires pour rassembler des documents, finaliser leurs comptes ou consulter un conseiller fiscal. Mais il y a une distinction importante à comprendre : une prolongation pour le dépôt n’est pas une prolongation pour le paiement.

Chaque canton suisse a son propre calendrier pour les échéances fiscales — la plupart se situent entre fin mars et début avril. Si vous ne pouvez pas respecter la date limite de déclaration d’impôts initiale, vous pouvez faire une demande de délai, ce qui repousse souvent l’échéance à la fin de l’été ou au début de l’automne, selon les politiques de votre canton.

Cependant, ce sursis ne s’applique qu’à la soumission de votre déclaration remplie. Tout impôt que vous devez payer doit toujours être réglé à la date d’échéance initiale. C’est un point qui surprend beaucoup de monde — retarder vos documents ne retarde pas votre obligation financière. Ne pas payer à temps, même si votre délai de dépôt a été prolongé, peut entraîner des intérêts moratoires ou des pénalités.

Nous vous offrons un accompagnement complet : avant, pendant et après la création de votre entreprise.

Qui devrait envisager de demander plus de temps ?

Divers types de personnes peuvent tirer avantage d’une demande de prolongation :

- Les propriétaires d’entreprise en attente de documents Si vous dirigez une entreprise, vous pourriez avoir besoin de relevés de banques, de fournisseurs ou de partenaires commerciaux. Parfois, ces documents arrivent en retard.

- Les personnes ayant plusieurs sources de revenus Si vous gagnez de l’argent de plusieurs sources – emploi, biens locatifs, investissements ou travail indépendant – votre situation fiscale se complique.

- Toute personne faisant face à des difficultés personnelles Des événements de la vie comme une maladie, des urgences familiales, un déménagement ou un changement d’emploi peuvent rendre difficile la concentration sur la paperasse.

- Les personnes qui veulent être méticuleuses Même si vos finances sont simples, vous pourriez vouloir plus de temps pour tout examiner attentivement ou attendre que votre comptable soit disponible.

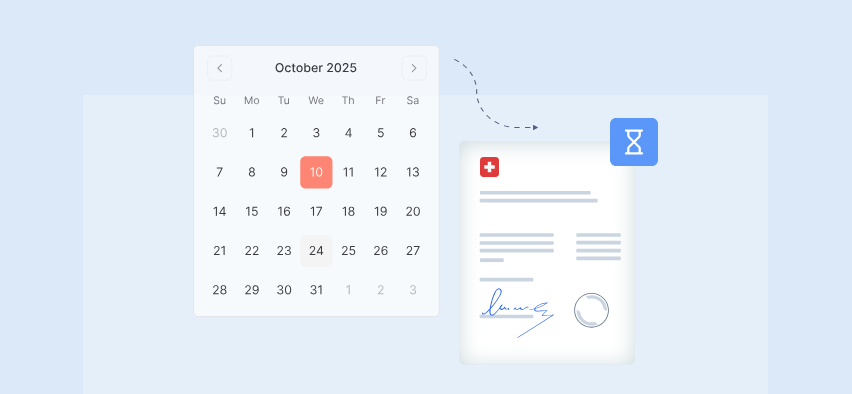

Quand demander plus de temps ?

La clé pour obtenir une prolongation de délai est de la demander avant l’expiration de votre délai initial. La plupart des cantons ont une date limite pour la déclaration d’impôts autour du 31 mars, mais cela peut varier légèrement.

Il est préférable de faire la demande en janvier ou février. Les demandes faites à l’avance sont presque toujours acceptées, vous évitant ainsi les soucis liés aux retards postaux ou aux problèmes de site web. En général, la plupart des cantons vous accorderont jusqu’en septembre ou octobre.

Comment effectuer votre demande de délai ?

Le processus est conçu pour être simple. Vous avez deux options principales :

- Option 1 : Demander en ligne (recommandé) La plupart des cantons suisses ont désormais des sites web où vous pouvez faire une demande de délai pour les impôts en quelques minutes. Vous obtiendrez généralement une confirmation immédiate à l’écran et par e-mail. Conservez ces confirmations.

- Option 2 : Demander par courrier Si vous préférez les formulaires papier, téléchargez le formulaire sur le site de votre canton ou utilisez celui fourni avec vos documents fiscaux. Assurez-vous que votre demande arrive avant la date limite.

Les informations de base requises sont votre nom complet, votre adresse, votre date de naissance et votre numéro de contribuable (généralement votre numéro AVS). La plupart des cantons ne demandent pas de justifier votre demande de délai.

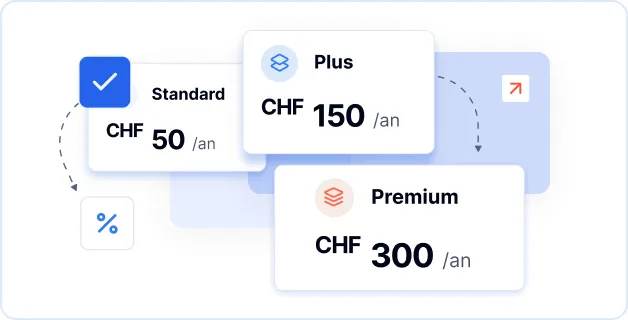

Quels sont les coûts associés à une prolongation de délai fiscal en Suisse ?

Dans la plupart des cantons, la première demande de prolongation de délai est gratuite. Elle est considérée comme un sursis pour permettre aux particuliers et aux entreprises de préparer leurs documents.

Si la première prolongation n’est pas suffisante, certains cantons autorisent une deuxième demande, mais celle-ci est souvent payante. Les frais administratifs varient généralement de 30 à 80 CHF. Par exemple, la demande de prolongation pour l’impôt dans le canton de Vaud peut entraîner des frais si une deuxième prolongation est demandée.

Les règles sont publiées sur les sites web des administrations fiscales cantonales. Les consulter en début d’année peut vous faire gagner du temps.

Point clé : les prolongations ne reportent pas vos paiements d’impôts

C’est l’aspect le plus important à comprendre : obtenir du temps supplémentaire pour soumettre vos documents ne prolonge pas votre délai de paiement des impôts.

- Votre paiement d’impôt reste dû à temps Même avec une prolongation acceptée, vous devez toujours régler vos acomptes provisionnels à la date d’échéance initiale.

- Des intérêts moratoires s’appliquent en cas de paiement tardif Si vous ne payez pas à temps, des intérêts seront facturés sur le solde restant.

- Les prolongations de paiement sont différentes Si vous rencontrez de réelles difficultés financières, vous devez faire une demande distincte pour une prolongation de paiement, qui est beaucoup plus difficile à obtenir.

Erreurs courantes à éviter

- Ne pas attendre le dernier jour : Les administrations fiscales suisses sont strictes. Si votre demande de délai arrive un jour en retard, elle peut être refusée.

- Ne pas confondre prolongation de dépôt et de paiement : C’est l’erreur la plus fréquente.

- Ne pas oublier de faire un paiement estimé : Il est judicieux de payer une estimation raisonnable pour réduire les intérêts potentiels.

- Ne pas oublier de conserver une preuve : Gardez toujours votre e-mail de confirmation ou votre reçu postal.

- Ne pas supposer que toutes les demandes sont automatiquement approuvées : Bien que la plupart le soient, ce n’est pas une garantie absolue.

Avantages d’obtenir une prolongation

- Des déclarations d’impôts de meilleure qualité : Avec plus de temps, vous pouvez vérifier vos calculs et ne manquer aucune déduction.

- Moins de stress : Savoir que vous avez plus de temps élimine la pression de la date limite pour les impôts.

- Le temps d’obtenir une aide professionnelle : Une prolongation vous donne plus de flexibilité pour prendre rendez-vous avec un comptable.

- L’opportunité de trouver des documents manquants : Vous pouvez inclure des documents qui arrivent tardivement.

Différentes règles selon les cantons

La Suisse compte 26 cantons, et chacun a des règles légèrement différentes concernant les délais pour les impôts. Les cantons urbains comme Zurich et Genève disposent souvent de systèmes en ligne sophistiqués. Il est toujours judicieux de vérifier le site web de l’administration fiscale de votre canton.

Conclusion

Obtenir une prolongation de délai pour la déclaration d’impôts est une option remarquablement accessible conçue pour alléger la pression.

Voici ce qu’il faut retenir : initiez votre demande de prolongation de délai bien avant l’échéance initiale. Comprenez bien que ce sursis ne concerne que la soumission de vos documents, et non le report des paiements dus. Par conséquent, la conservation d’une preuve de votre demande est primordiale.

Même avec une prolongation, l’horloge fiscale pour les paiements continue de tourner. Envoyer un paiement estimé bien réfléchi avant la date limite initiale est une démarche avisée.

En maîtrisant ces mécanismes fondamentaux, vous ne réagissez pas simplement à une échéance ; vous façonnez pro-activement votre calendrier fiscal. Cette approche pragmatique vous permet de préparer une déclaration d’impôt précise et complète, sans la précipitation de dernière minute qui mène souvent à des erreurs.