Comptabilité de caisse ou comptabilité d’exercice en Suisse : clarifiez la situation financière de votre entreprise

Pour tout dirigeant souhaitant s’imposer durablement dans le paysage économique suisse, le suivi rigoureux de chaque flux financier est fondamental.

Ce choix dépasse la simple formalité administrative : il conditionne directement votre sérénité mentale, vos rapports aux institutions fiscales et, à terme, la trajectoire même de votre société.

Si vous êtes à la tête d’une entreprise suisse, envisagez-vous de privilégier la méthode simple et directe de la comptabilité de caisse, ou penchez-vous pour une approche plus analytique comme la comptabilité d’engagement ? Cette décision n’est pas à prendre à la légère : elle impacte notamment l’obtention de crédits ou la perception externe de la stabilité financière de votre structure.

Explorons ces deux méthodes à travers des cas typiquement suisses pour vous accompagner dans le choix de l’approche la plus pertinente selon vos objectifs.

Pourquoi votre choix comptable est-il si important ?

Imaginez votre système comptable comme le baromètre de la vitalité financière de votre entreprise. Il retrace chaque entrée et sortie monétaire avec précision, mettant en lumière l’état réel de vos activités ainsi que votre potentiel d’évolution.

- La comptabilité de caisse reflète en temps réel le solde de vos disponibilités bancaires.

- La comptabilité d’exercice permet de dresser un panorama comptable complet, reflétant les opérations réalisées même si les flux n’ont pas encore été concrétisés.

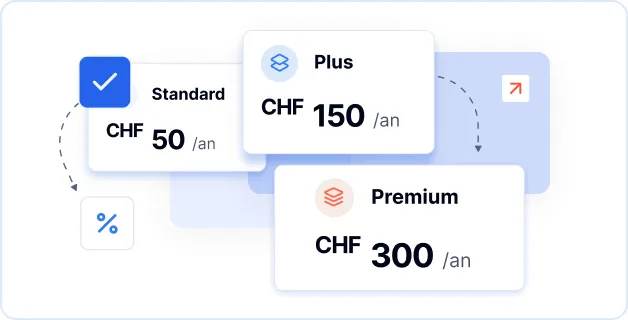

Les structures dont les revenus annuels restent sous la barre des 500 000 CHF peuvent recourir à la méthode de caisse.

En revanche, les organisations plus complexes ou soumises à la TVA, comme les SA ou Sàrl, doivent impérativement adopter la méthode par engagement. Ce n’est pas un simple choix personnel, mais bien une exigence réglementaire.

Pourquoi choisir la comptabilité de caisse ?

C’est la méthode la plus accessible et intuitive.

Essentiellement, elle repose sur la traçabilité des flux monétaires réels : vous comptabilisez les recettes et les dépenses uniquement au moment où l’argent est effectivement encaissé ou déboursé.

Comment ça marche ?

- Vous achetez un ordinateur : la sortie d’argent est comptabilisée au moment du paiement.

- Un client règle une prestation le jour même : vous saisissez ce revenu dès réception.

Son attrait réside dans sa clarté, sa gestion facilitée, et sa parfaite correspondance avec le relevé bancaire, ce qui simplifie les vérifications et rapprochements.

Méthode idéale pour :

Cette méthode convient souvent aux :

- Entreprises individuelles (raison individuelle)

- Indépendants (freelances)

- Petits commerçants ou artisans avec des transactions immédiates.

- Entreprises de services familiales avec des paiements instantanés.

Exemple suisse concret : La “Berner Bäckerstube”

Imaginez la “Berner Bäckerstube” de Stefan, une boulangerie locale appréciée. Stefan vend son pain directement et reçoit un paiement immédiat. Il achète sa farine en payant comptant à la livraison. La comptabilité de caisse s’aligne parfaitement sur son flux de trésorerie quotidien et immédiat, lui donnant une vue claire et en temps réel de ses revenus. Pas de factures en attente, juste les totaux du jour.

La comptabilité d’exercice : le plan financier stratégique

La comptabilité d’exercice transcende la simple tenue de la comptabilité. Elle vise à dévoiler le récit économique complet de votre entreprise. Cette méthode, qui est une forme de comptabilité double, enregistre méticuleusement les revenus et les dépenses au moment précis où ils sont acquis ou engagés, dissociant fondamentalement cette reconnaissance de l’échange physique d’argent.

Comment ça marche ?

- Imaginez un projet de conseil que vous terminez en mars, mais dont le paiement du client n’est dû qu’en avril. En comptabilité d’exercice, vous reconnaissez immédiatement ce revenu en mars, reflétant le moment où la valeur a été livrée, et non celui où l’argent est arrivé.

- De même, si vous recevez en mai une facture d’électricité pour des services déjà consommés, mais que vous ne la payez qu’en juin, vous enregistrez cette dépense en mai. Cela garantit que le coût est rattaché à la période dont il a bénéficié.

Cette approche raffinée agit comme un prisme financier, alignant de manière experte la génération de revenus avec les coûts précis engagés pour la créer, présentant une réflexion fidèle et par période de votre cycle opérationnel et de votre rentabilité.

Méthode idéale pour :

- Les startups et les scale-ups avec des modèles de revenus complexes.

- Les sociétés de capitaux (SA et Sàrl).

- Les entreprises accordant des délais de paiement.

- Les entreprises assujetties à la TVA.

Exemple suisse concret : Helvetia Digital Solutions SA

Helvetia Digital Solutions SA, une société de logiciels basée à Zurich, facture ses clients mensuellement pour des contrats de service continus, avec des paiements souvent effectués 30 à 60 jours plus tard. En utilisant la comptabilité d’exercice, elle reconnaît les revenus à mesure que chaque module est terminé et accepté, et enregistre les dépenses (comme les salaires des développeurs) lorsqu’elles sont engagées. Cela offre une vue précise et globale de la rentabilité des projets et de la santé financière, ce qui est crucial pour les relations avec les investisseurs et la planification.

Principales différences : comparaison des philosophies comptables

| Caractéristique | Approche de la comptabilité de caisse | Perspective de la comptabilité d’exercice |

| Reconnaissance des revenus | Lorsque l’argent arrive sur votre compte. | Lorsque la valeur est livrée/les services rendus. |

| Enregistrement des dépenses | Lorsque les fonds quittent votre compte. | Lorsque le coût est engagé/la facture reçue. |

| Niveau de complexité | Minimal ; comme un chéquier personnel. | Modéré à élevé ; exige un suivi détaillé. |

| Vision financière | Aperçu direct et immédiat de la trésorerie. | Performance complète et par période. |

| Champ d’application réglementaire suisse | Autorisée pour certaines petites entités (< 500k CHF). | Obligatoire pour > 500k CHF, assujettis à la TVA ou SA/Sàrl. |

Avantages et inconvénients : pesez vos options

Comptabilité de caisse : les avantages

- Simple et intuitive : Facile à comprendre, surtout pour les non-comptables.

- Réconciliation aisée : S’aligne directement sur les relevés bancaires.

- Charge administrative réduite : Moins de tâches de tenue de comptes.

- Parfaite pour les micro-entreprises : Idéale pour les transactions immédiates.

Comptabilité de caisse : les inconvénients

- Risque de rentabilité trompeuse : Ne tient pas compte des dettes et créances en attente, ce qui peut fausser la performance.

- Applicabilité limitée : Non acceptée pour les grandes entreprises ou celles cherchant un financement externe.

- Vision financière limitée : Ne révèle pas les revenus ou obligations futurs, ce qui entrave la planification stratégique.

Comptabilité d’exercice : les avantages

- Mesure précise de la performance : Offre une vision non filtrée des revenus gagnés et des dépenses réellement engagées.

- Permet une prévoyance stratégique : Constitue la base d’une budgétisation robuste et de décisions à long terme.

- Confiance des parties prenantes et conformité : La norme attendue par les investisseurs et les banques.

Comptabilité d’exercice : les défis

- Complexité accrue : Exige un suivi rigoureux des encaissements, des décaissements et des créances/dettes.

- Gestion des créances et des dettes : Nécessite des systèmes internes robustes pour gérer les factures clients et fournisseurs.

- Angles morts potentiels sur la trésorerie : Peut montrer une rentabilité alors que les liquidités sont faibles si les paiements des clients sont retardés.

Réglementations suisses : une considération obligatoire

Les réglementations financières suisses (Code des Obligations, Administration fédérale des contributions) sont claires : il existe une obligation de tenir une comptabilité.

- Chiffre d’affaires inférieur à 500 000 CHF : La comptabilité de caisse est généralement autorisée pour les raisons individuelles et certaines sociétés de personnes non assujetties à la TVA.

- Chiffre d’affaires supérieur à 500 000 CHF, assujetti à la TVA, ou Sàrl/SA : La comptabilité d’exercice est légalement obligatoire.

La cohérence est primordiale. Les changements fréquents de méthode sont déconseillés et peuvent attirer l’attention des autorités.

Scénarios concrets en Suisse : cas pratiques

- La fromagerie d’Anna à Berne – Comptabilité de caisse : Anna vend directement ses fromages et règle ses fournisseurs à l’avance. Cette méthode convient parfaitement à sa gestion immédiate de trésorerie.

- Alpine Creative Hub Sàrl (Agence marketing) à Zurich – Comptabilité d’exercice : Cette agence facture ses campagnes sur plusieurs mois, avec des paiements échelonnés entre 30 et 60 jours. La comptabilité d’engagement leur permet de répartir les revenus au rythme de l’avancement des projets.

- Lausanne Architectural Designs SA – Comptabilité d’exercice : Ce cabinet gère des projets de longue durée. Il associe les recettes et les dépenses à l’évolution du chantier, permettant d’avoir une vision précise de la rentabilité.

Changer de méthode : Un processus structuré, étape par étape

De nombreuses PME en plein développement adoptent une transition de la comptabilité de caisse vers celle d’engagement. Voici une feuille de route classique :

- Examen complet : Examinez méticuleusement les créances ainsi que les dettes en suspens.

- Ajustement des soldes d’ouverture : Mettez à jour votre système comptable pour refléter ces soldes.

- Harmonisation des états comptables : Garantissez la continuité entre les anciens et les nouveaux relevés financiers.

- Consultation professionnelle : Faites appel à un fiduciaire ou à un expert-comptable basé en Suisse pour sécuriser les démarches légales et techniques.

- Communication officielle : Informez l’Administration fédérale des contributions si nécessaire ; documentez tous les changements.

Votre boussole décisionnelle : tracez votre voie

Pour sélectionner la méthode comptable la mieux adaptée, posez-vous ces quelques questions :

- Votre chiffre d’affaires annuel reste-t-il sous le seuil des 500 000 CHF, et exercez-vous en tant qu’indépendant ou via une société de personnes non soumise à la TVA ?

- Si oui : La comptabilité de caisse suffira probablement.

- Émettez-vous fréquemment des factures avec des délais de paiement, gérez-vous des stocks ou accordez-vous régulièrement des crédits ?

- Si oui : La comptabilité d’exercice offrira une vision financière beaucoup plus précise.

- Votre entreprise est-elle une Sàrl ou une SA, ou êtes-vous assujetti à la TVA ?

- Si oui : Vous êtes légalement tenu d’appliquer la comptabilité d’exercice.

- Cherchez-vous activement des prêts bancaires, des investissements externes importants ou prévoyez-vous d’attirer de nouveaux investisseurs ?

- Si oui : Les rapports basés sur la comptabilité d’exercice sont la norme universellement attendue.

Une réponse “oui” à l’une des trois dernières questions indique fortement que la comptabilité d’exercice est le choix correct, voire obligatoire.

Conseils de mise en œuvre pratique

- Pour la comptabilité de caisse :

- Séparez rigoureusement les comptes professionnels et personnels.

- Saisissez rapidement les transactions quotidiennes.

- Effectuez une réconciliation bancaire hebdomadaire ou mensuelle.

- Utilisez des logiciels conviviaux comme Bexio ou même un tableur structuré.

- Pour la comptabilité d’exercice :

- Mettez en place un système robuste de suivi des factures clients (créances).

- Mettez à jour régulièrement les registres des factures impayées (dettes).

- Investissez dans un logiciel de comptabilité commerciale complet comme Xero, Abacus, Sage ou QuickBooks.

- Envisagez de faire appel à une fiduciaire pour la précision et la conformité.

Répondre aux appréhensions courantes

- “La comptabilité d’exercice masquera-t-elle les problèmes de trésorerie ?” Non. Associée à un prévisionnel de trésorerie, elle fournit une image complète : performance (exercice) et liquidité (trésorerie).

- “Puis-je revenir à la comptabilité de caisse plus tard ?” Si la loi le permet (par ex., chiffre d’affaires < 500k CHF), oui, mais cela nécessite une documentation méticuleuse.

- “Existe-t-il une option ‘hybride’ ?” Non. Le mélange informel n’est pas recommandé en Suisse ; il peut causer de la confusion.

Quand la croissance exige une évolution stratégique

À mesure que les entreprises suisses mûrissent, les investisseurs exigent une transparence approfondie et les audits réglementaires deviennent plus fréquents. Ce changement marque une avancée significative dans la gestion de l’organisation. Il permet notamment :

- Une solution incontournable pour établir un budget réaliste et structurer les finances.

- Une compréhension globale des dettes et créances.

- Des fondations fiables pour formuler des prévisions, évaluer des indicateurs clés et analyser les performances.

En résumé : comment choisir le mode comptable le plus pertinent ?

- Pour les micro-entreprises (< 500k CHF) avec une gestion simple des flux monétaires : la comptabilité de caisse reste l’option la plus intuitive.

- Sociétés gérant crédits, facturation, inventaires ou opérant sous forme de Sàrl/SA et soumises à la TVA : elles adoptent généralement la comptabilité d’exercice, souvent indispensable.

- Structures en développement ou en phase de levée de fonds : cette méthode permet de générer des documents fiables, répondant aux standards des partenaires et investisseurs.

La méthode comptable que vous adoptez doit être le socle solide de votre stratégie de pilotage.

Étapes pratiques pour les entreprises en Suisse :

- Faites un bilan complet : analysez les rentrées d’argent passées et projetez celles à venir.

- Cernez vos besoins spécifiques : identifiez vos circuits de facturation et de gestion de stock.

- Préparez le changement : si l’option d’exercice s’impose, anticipez et planifiez la migration.

- Appuyez-vous sur un professionnel : un expert-comptable suisse peut vous accompagner.

- Choisissez un outil adapté : utilisez une plateforme (par ex., Xero, Bexio, KLARA, etc.) alignée avec les normes locales.

- Structurez vos processus : formalisez vos routines comptables et engagez-vous à effectuer des rapprochements réguliers.

Réflexions finales : choisir le chemin comptable convenable pour vous

Trouver la méthode de comptabilité qui s’aligne avec vos réalités revient à choisir un prisme à travers lequel vous percevez votre entreprise. Si la fiabilité des chiffres ne fait pas encore partie de vos habitudes, il est temps d’y remédier. Une méthode bien choisie vous offrira une vue limpide sur votre situation financière, et vous aidera à anticiper, ajuster et prospérer.